Tag: europe

Fire Protection for Li-Ion Batteries

The fire risks of a Li-Ion battery system due to their high potential fire load have to be handled with great care. However with the right measures the risk can be reduced and a safe operation be ensured. They best way to prevent a fire from happening is an early detection of gaseous electrolyte and an inerting of the battery room with e.g. nitrogen or carbon dioxide. This procedure is described and recommended by Siemens in a published white paper form January 2019. Siemens offers as well the fire protection equipment as the FDA241 air sampling detector in combination with the Sinorix N2 extinguishing system.

Cellution offers a risk analysis regarding the fire risks of a Li-Ion battery system as well as a fire protection concept. Please feel free to get in contact with us for details.

2nd Life Application for EV Batteries

As you may know, Li-Ion batteries loose their capacity (kWh) over their lifetime. At a certain point this means for electrical vehicles, that the range (km), which depends on the battery capacity, is not sufficient anymore. This happens after approximately 5-10 years operation, depending on the behavior of the car owner. What happens with the battery of an electric vehicle after reaching this point? There are three different possible scenarios: disposal, recycling or reuse. The disposal is the most common method and results in a simple combustion of the batter, which is of course not a sustainable use of raw material and neither is it good for the environment. The second option is recycling, where the raw material like cobalt, nickel or manganese is extracted and reprocessed. The third option is to reuse the batteries and give them a 2ndlife.

The batteries after operation in an electric vehicle may have not enough capacity left to satisfy the requirements of transportation but may are still suitable for other applications. This could be e.g. frequency response for the electricity grid or a back up system for a data center. These are stationary applications, which require many battery packs of electric vehicles connected in series and parallel to form a so called utility-scale battery system. Different OEMs like Daimler or Nissan are already working with used EV batteries to develop 2ndlife applications.

The volumes of used EV batteries will be huge in the future with the growing amount of EVs in Europe. This amount can even overcome the amount of new installed stationary utility-scale batteries by 2030.

Despite the huge potential of 2ndlife EV batteries there are as well challenges to overcome like regulations for used battery applications or standards for the development of battery packs, as every OEM has their own battery pack design. Despite that already battery manufacturers are developing different cells for EV and stationary applications (as well called “ESS – Energy Storage System”). This makes totally sense as cells for EV need a high energy density and a lifetime of ~1000 cycles, which results in ~300 000km. Cells for stationary applications need a lifetime of more than ~4000 cycles to realize a feasible business case and the energy density is not as critical as for mobile applications.

2ndlife will definitely be an application that will find its place in the stationary market for a certain duration and is a very good alternative to a direct disposal. But in my opinion in the future the battery packs for EV will be designed for a shorter lifetime to fit the requirements for the this particular applications and afterwards go to a recycling process to extract the raw material. For stationary applications different cells are being developed and with decreasing battery prices the purchase of new batteries will be more economical rather than using the EV batteries after their first end of life.

Please find below an article regarding this topic from McKinsey, which shows most of the aspects discussed above more in detail.

Link to article by McKinsey

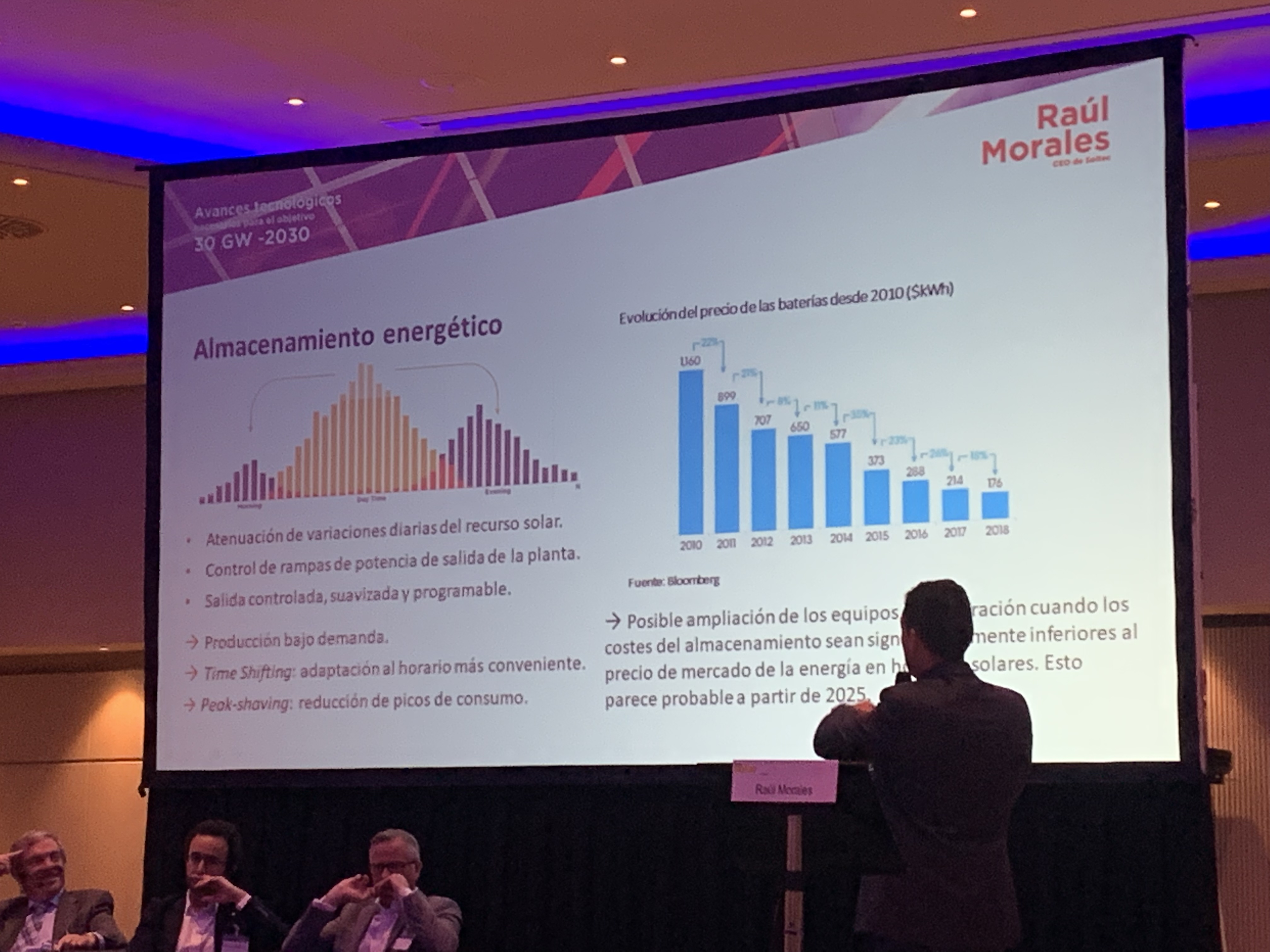

Intersolar Summit Spain 2019 – Solar Growth in Spain brings New Opportunities for Energy Storage

At the Intersolar Summit Spain 2019 in Barcelona this week on the 18th of June the Solar community got together and discussed the national plan for energy and environment. This plan includes the target of Spain having 74% renewable electricity supply in 2030 which will include new PV installation of 28GW from 2020 to 2030. This means an installation of 2800MW of Solar in average each year from 2020 to 2030. Compared with the installation in 2018 of roughly 260MW this will be a huge increase for the next 10 years in Spain.

Most Common Business Model – PPA

Together with increased PV installation the opportunities for energy storage will rise. In Spain are great opportunities for Power Purchase Agreements (PPAs) according to Bruce Douglas, Deputy CEO and COO at SolarPower Europe. Within a PPA most commonly a price for the electricity purchase is fixed over a certain duration. But as presented within the Intersolar Summit there are many different possibilities for PPAs as presented by Nicolas Gourvitch (Founder of Green Giraffe).

Opportunities for Energy Storage – Merchant and Energy Shifting

Merchant

For example, together with PPAs, energy storage can bring benefit to Solar energy providers by storing energy in case the electricity price at EEX (European Energy Exchange AG) is lower than the contracted PPA price. This energy can be traded at the EEX in case the current price index is above the contracted PPA price. This is just one example for an application of a battery system combined with PV.

Energy Shifting

According to Raúl Morales (CEO at Soltec) there will be an overproduction of Solar energy during the midday, which results in an electricity price of zero or even negative values. This scenario will get more and more important with the raise of Solar power and brings huge potential for energy shifting with storage solutions like batteries. This statement was backed up by the Spanish TSO Red Eléctrica (presented by Paula Junco, Tecnico de la Dirección de Operacioines) for the winter months. There is a big potential for energy shifting although in the summer months the solar power will match the electricity demand in the near future.

Solar needs storage to compete in National Grid’s UK Capacity Market redesign

National Grid has outlined how renewables could participate in the UK’s Capacity Market, unveiling technology-specific de-rating factors that range from 1–15%.

However National Grid’s Daniel Burke warned that there remains a long way to go before renewables can participate in CM auctions, not least because of the need for policy reform.

Any introduction of renewable energy into the CM would require regulatory overhaul from BEIS and market regulator Ofgem, matters which, Burke said, mean it is “quite feasible” to “take some time”.

Neueste Kommentare