Tag: energystorage

Cellution Corporate Presentation

Please review our corporate presentation to learn more about our services and background information regarding stationary energy storage.

Download: Cellution Company Introduction (English)

Fire Protection for Li-Ion Batteries

The fire risks of a Li-Ion battery system due to their high potential fire load have to be handled with great care. However with the right measures the risk can be reduced and a safe operation be ensured. They best way to prevent a fire from happening is an early detection of gaseous electrolyte and an inerting of the battery room with e.g. nitrogen or carbon dioxide. This procedure is described and recommended by Siemens in a published white paper form January 2019. Siemens offers as well the fire protection equipment as the FDA241 air sampling detector in combination with the Sinorix N2 extinguishing system.

Cellution offers a risk analysis regarding the fire risks of a Li-Ion battery system as well as a fire protection concept. Please feel free to get in contact with us for details.

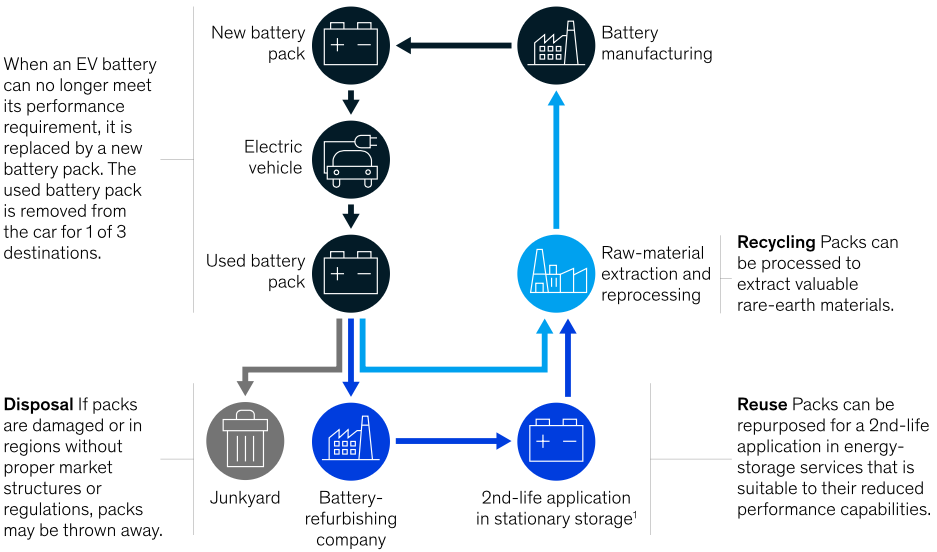

2nd Life Application for EV Batteries

As you may know, Li-Ion batteries loose their capacity (kWh) over their lifetime. At a certain point this means for electrical vehicles, that the range (km), which depends on the battery capacity, is not sufficient anymore. This happens after approximately 5-10 years operation, depending on the behavior of the car owner. What happens with the battery of an electric vehicle after reaching this point? There are three different possible scenarios: disposal, recycling or reuse. The disposal is the most common method and results in a simple combustion of the batter, which is of course not a sustainable use of raw material and neither is it good for the environment. The second option is recycling, where the raw material like cobalt, nickel or manganese is extracted and reprocessed. The third option is to reuse the batteries and give them a 2ndlife.

The batteries after operation in an electric vehicle may have not enough capacity left to satisfy the requirements of transportation but may are still suitable for other applications. This could be e.g. frequency response for the electricity grid or a back up system for a data center. These are stationary applications, which require many battery packs of electric vehicles connected in series and parallel to form a so called utility-scale battery system. Different OEMs like Daimler or Nissan are already working with used EV batteries to develop 2ndlife applications.

The volumes of used EV batteries will be huge in the future with the growing amount of EVs in Europe. This amount can even overcome the amount of new installed stationary utility-scale batteries by 2030.

Despite the huge potential of 2ndlife EV batteries there are as well challenges to overcome like regulations for used battery applications or standards for the development of battery packs, as every OEM has their own battery pack design. Despite that already battery manufacturers are developing different cells for EV and stationary applications (as well called “ESS – Energy Storage System”). This makes totally sense as cells for EV need a high energy density and a lifetime of ~1000 cycles, which results in ~300 000km. Cells for stationary applications need a lifetime of more than ~4000 cycles to realize a feasible business case and the energy density is not as critical as for mobile applications.

2ndlife will definitely be an application that will find its place in the stationary market for a certain duration and is a very good alternative to a direct disposal. But in my opinion in the future the battery packs for EV will be designed for a shorter lifetime to fit the requirements for the this particular applications and afterwards go to a recycling process to extract the raw material. For stationary applications different cells are being developed and with decreasing battery prices the purchase of new batteries will be more economical rather than using the EV batteries after their first end of life.

Please find below an article regarding this topic from McKinsey, which shows most of the aspects discussed above more in detail.

Link to article by McKinsey

Recycling of Li-Ion Batteries

Worldwide more than 5% of all Li-Ion batteries are being recycled. This low amount is due to the fact that recycling of Li-Ion batteries as today is not an economical feasible business case. Even though raw material prices raise in the past years (especially Cobalt) but still there is no break even point reached in this process. Additionally the responsibility for the disposal or recycling is shifted from the battery manufacturer to buyers in Europe. This is an important point in the negotiation with a battery manufacturer that should be looked at closer and not be forgotten in a n economical analysis of the whole lifetime of a battery system.

In the future due to new recycling methods more batteries surely will be recycled and hopefully we will reach 100% recycle rate one day. According to an article of energy-storage.news and a Canada-based recycler a 100% recycle rate of Li-Ion batteries is achievable.

Wind + Storage in Germany

Wind + Storage in Germany is not an easy business case at the moment to develop. Projects like the one below from EWE only work due to big investment from the Japanese Organization NEDO (New Energy and Industrial Technology Development Organization). In case the production of electricity by the wind park is too high for the grid or the prices at the stock are negative, the operator has to turn down the power or even completely shut the whole wind park down. The problem is that the operator gets paid the whole amount he lost due to being prevented to produce electricity. This regulation erases one major benefit a combination with energy storage would offer. Nevertheless cellution is working with wind project developers in Germany on the development of economical feasible business models that combine a broad variety of revenue streams a battery can offer to a wind park. Get in contact with us to discuss opportunities for wind+storage in Europe and we will support you during the evaluation of the business case.

O&M in Energy Storage

Operation and Maintenance is a critical factor in energy storage systems as availability is key to a successful business model and often required by contractual circumstances with customers or grid operators. Not only is non-availability lowering the revenue of a plant, it can as well causing liquidated damages or even harm business relationships on a ling term.

An battery energy storage system is complex and consists of many parts which in total requires a interdisciplinary team to cover all upcoming problems during O&M. From my time at Vattenfall in the maintenance of conventional power plants I experienced that the maintenance is limited nowadays to reactive maintenance. When a part has a failure, the asset manager reacts and mostly replace the part. In case of battery systems this methodology will not succeed on a long term as availability is a crucial factor. Here we will experience the advantages of predictive maintenance with machine learning and big data analysis to lear more about battery operational behavior and failure prediction.

Read an interesting article from energy-storage.news here

Solar needs storage to compete in National Grid’s UK Capacity Market redesign

National Grid has outlined how renewables could participate in the UK’s Capacity Market, unveiling technology-specific de-rating factors that range from 1–15%.

However National Grid’s Daniel Burke warned that there remains a long way to go before renewables can participate in CM auctions, not least because of the need for policy reform.

Any introduction of renewable energy into the CM would require regulatory overhaul from BEIS and market regulator Ofgem, matters which, Burke said, mean it is “quite feasible” to “take some time”.

Wind, solar could be self-financing by 2025 under current European electricity market design

According to the Centre on Regulation in Europe (CERRE), Large-scale solar and wind power projects may already be able to compete in Europe’s wholesale electricity market in 2025. Lower capital costs for large-scale wind and solar projects, and much higher fossil fuel and carbon prices could lead to renewables becoming self-financing by 2025. If these conditions do not materialize, more auctions and tenders may still be needed.

In our opinon at cellution battery technology can help developing more economical models for wind and solar energy in the future and may enable renewables even befor 2025 to compete with conventional energy applications.

Read the full article on PV Magazine

Wind, solar could be self-financing by 2025 under current European electricity market design

Sharing batteries for grid services could net US$2,500 discounts for EDF’s UK customers

EDF Energy is seeking to build a portfolio of domestic batteries to take into energy services markets by offering discounted energy storage units to consumers via a new partnership with manufacturer Powervault. The pair is offering existing solar PV owners as much as £2,000 off the cost of a home battery system if they sign up to EDF Energy grid services. If taken up, this will allow the energy stored in a Powervault 3 battery to form part of an aggregated network that can be used to help balance the grid.

Read the full article on Energy Storage News: https://www.energy-storage.news/news/sharing-batteries-for-grid-services-could-net-us2500-discounts-for-edfs-uk

Nordic region’s largest battery will assist 44MW hydropower plant as it balances the grid

Fortum announced that it will install the newest 5MW/6.2MWh battery energy storage system (BESS) at Forshuvud hydropower plant. It is one of dozens of hydropower plants Fortum owns and operates running off the Dalälven river’s catchment area through central Sweden. As with the Järvenpää battery, the Forshuvud battery will provide frequency regulation services. Forshuvud is a 44MW plant generating around 209.8GWh of electricity annually and is 88% owned by Fortum.

Read the full article on Nergy Storage News: https://www.energy-storage.news/news/nordic-regions-largest-battery-will-assist-44mw-hydropower-plant-as-it-bala

Recent Comments